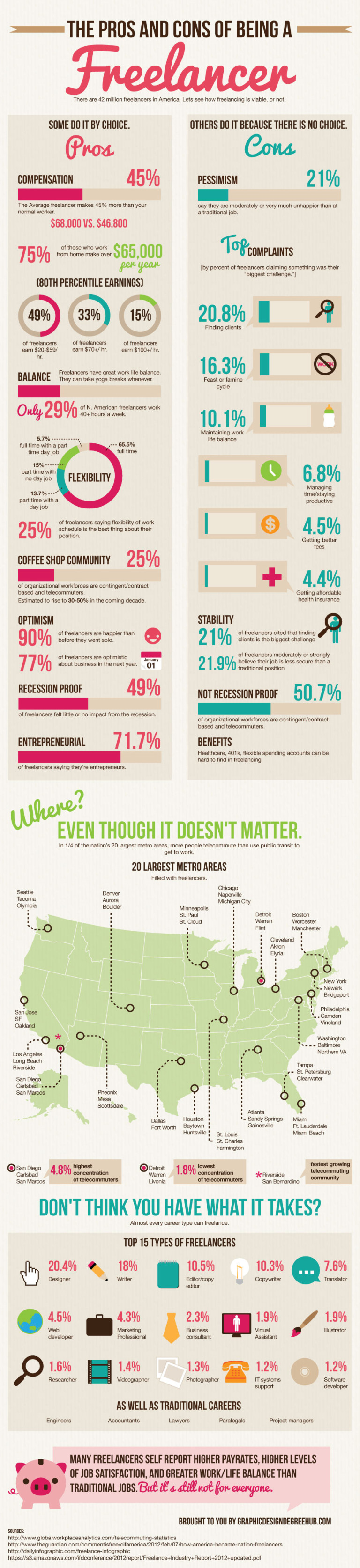

An increasing number of creative professionals—particularly writers—are making the transition from full-time employment to freelance employment.

Some do it by choice, looking for freedom, greater cash flow and more favorable work-life balance. Others become freelancers by force, as cash-strapped employers look for ways to cut costs without losing valuable talent.

Is freelancing right for you? Are you right for freelancing? There are no cookie-cutter answers to these questions, but weighing the pros and cons can help you come to right conclusion for your unique situation.

But as always, there is another side of the coin: Because freelancers must take on all of the extra hassle of handling taxes, tracking hours, etc.—not to mention releasing their employer from these responsibilities and their associated costs—they are often able to negotiate higher pay, which they will receive pre-tax. This means that working freelancers can often achieve greater cash flow versus salaried employees—assuming they get enough projects to rival a full-timer’s workload.

Another consideration is whether or not you live in the same state as your employer. Employees who reside in a different state from their employer’s main office are often best-suited to become contract employees. Otherwise, Nexus laws require companies to pay state sales taxes to states within which they have even just one full-time employee present. Setting up employees as remote contractors, in this case, allows companies to opt out of state sales taxes, which in turn saves them tens of thousands of dollars (millions for larger companies) and gives you negotiating leverage for higher pay.

Yet another consideration are home-office income tax write-offs, which allow people who work exclusively from home to deduct the expenses incurred from doing so, such as (for homeowners only) a percentage deduction from your mortgage payment equivalent to the percentage of square-footage your home-office occupies, as well as deductions for the office supplies and utility bills incurred from running the home-office.

Thanks to the folks over at DesignTAXI, an online journal for creative types, here is a handy dandy, side-by-side comparison of some of the most pressing questions people face when considering whether or not to go freelance. (That is, if you are among the people who are fortunate enough to make the decision for yourself.)

Editor’s note: We are not licensed tax advisers. Please consult a tax professional to ask about all of the tax requirements and benefits for your specific situation before you make a decision.